By Jae Christian | Instagram: thejaechristian Twitter: thejaechristian | Facebook: www.facebook.com/thejaechristian

By Jae Christian | Instagram: thejaechristian Twitter: thejaechristian | Facebook: www.facebook.com/thejaechristian

Trying to decide whether renting or buying is a better option for you depends on many factors. The better choice for you often depends on your circumstances from a financial and personal perspective. Knowing your financial limitations can be a big factor in determining if you should stay a renter or become a homeowner. From a financial standpoint, you should ask yourself: “Would I need to make changes to my budget? Do I have money saved for closing costs? Can I afford the extra costs associated with owning a home? Would owning a home stretch my financial limits? Both renting and buying have advantages and disadvantages.

Advantages of Renting

Renting allows you to have a level of flexibility that home ownership doesn’t. You are able to enter into short term or long term leases, whereas with buying you are locked in for the next 15-30 years unless you sell your home. As a renter, you have lower initial costs associated with moving in. While renting, you also do not have to face the major responsibilities or extra costs that come with being a homeowner, such as maintenance repairs, the up keep of the property, and paying property taxes or insurance fees.

Disadvantages of Renting

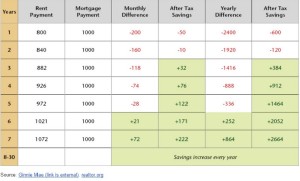

As a renter, you do not gain any equity in the property or get any tax breaks. You are making monthly payments that are not being invested for long term security. As an renter, you are putting money into someone else’s pockets every month, ultimately earning no return in your investment. By renting, you also have no control over your living quarters and are subject to many regulations. You have no say so in the place you call home! Renting an apartment or home is always an temporary situation. At anytime, a landlord or rental company could ask you to leave or increase the rental amount. Due to inflation pushing up the cost of living, apartment rental amounts tend to increase every year, whereas a mortgage payments do not change.

Disadvantages of Buying

Buying a home is a big financial and long term commitment, as well as a major responsibility. You have to really be prepared beforehand, and have a strong idea of where your life is headed over the next few years. There’s also the matter of having money saved up to cover extra costs. When you buy a home, you are responsible for all the maintenance and up keep of the property. You have to make sure you are never late on monthly payments because you can risk the chance of your home going into foreclosure.

There is a lot to think about when making the decision to rent or buy. You have to decide if saving money up front or investing in your own future and building equity over time is something that is more important to you. Although renting may seem less expensive at the time and have less cost associated with it, owning a home has a lot more incentives and advantages in the long run! Home ownership is not for everyone, but it can be incredibly rewarding. To decide if renting or buying is an better option for you, check out the pros and cons associated with both before you make a decision.

Buy vs. Rent Comparison